October 24, 2012

I got this electronic notice from the court today The banks response to my informal opening brief was originally due in February of 2012.

Documenting the greed of Wall Street banking, and my personal quest for justice against those banksters.

Wednesday, October 24, 2012

Saturday, October 13, 2012

What do White-Winged Doves have to do with Economics?

By: D_Sherman_Okst

Everything!

Everything!

This short, nonfiction, tragicomedy personifies what is wrong with our country, our economy and our totally inept and very dysfunctional legal system that has become a leech to taxpayers and a threat to humanity.

The Great Depression of the 1930s was brought upon by lawlessness. Documented, historical proof that a functioning economy is dependent on a basic legal framework. One that we no longer have.

It has been dismantled to allow a few megalomaniac psychopaths on Wall Street to become even richer.

‘A Wild Game’ is a byproduct of Corporatocracy which I wrote about in “Why We Are Totally Finished.” It correlates how idiotic laws threaten innocent Americans like Ryan Adams, a fellow blogger who writes about gourmet cooking. It clearly shows how common sense laws that protect innocent Americans were removed to enrich greedy psychopathic banksters and politicians.

Here is an excerpt from gourmet blogger Ryan Adam’s blog titled, ‘When life gives you wild game...’:

A few weeks ago, my wife and I were relaxing on the couch watching Project Runway—what?—when a loud “BAM” startled us and sent our pups into fits of barking. Initially we assumed that a stray baseball from a neighbor’s yard was the cause, but once outside we discovered this poor little guy. For whatever reason a White-winged Dove had gone kamikaze, breaking his neck in the process.Coincidentally, dove season in Texas had started not twenty four hours earlier. Here in Texas, the dove hunting season is very popular. In 1999 alone an estimated 607,000 white-wings were harvested by hunters during the month of September. People travel long distances and pay big bucks to hunt these birds, and one had just been dropped into my hands.A lot of people would either bury or throw away a dead animal under these circumstances.I am not one of them.

Well, you know where this went...

Not only did he eat the bird that committed suicide-but he posted about a dozen instructional pictures of himself preparing the gourmet grilling—“La Mancha” style.

“Our” fine country holds less than 5 percent of the world’s populous but a quarter (25 percent) of the world’s entire prison population.

What does this have to do with our featherless friend above? You’re about to find out why.

Not one prisoner is a bankster that blew our economy to hell. The banksters decimated the housing market. A market responsible for one in six jobs. Put actual unemployment at 23.8%. Stole fortunes from every homeowner. Created massive amounts of fraudulent loans. Filled courthouses with fraudulent falsified forged documentation once called legal deeds of trust. They bundled these fraudulent loans and sold them as investments to pension funds, individual investors, cities and countries. Then sold them to anyone who would swallow anything marked Triple-A when Wall Street called them.

The banksters pressured the rating agencies to rate the investments without allowing underwriters to look at individual loan documentation. Where I was born they call this falsification, fraud, extortion and bribery.

Then they shorted the companies that were selling insurance policies on those very investments “should" they go bad because they knew they would go bad. While they were shorting AIG they cleared their books by selling “crap” (as they called it in their internal emails) to their own clients who they called Muppets or Dumb Money. And when things looked bad for AIG they bought insurance to protect their shorts that they had riding on AIG because they knew AIG would tank before AIG knew it was in trouble.

Another bank, UBS, created a new family of “feeder funds” to send their clients' assets to Madoff. Madoff paid them 4 percent per year for sending him clients so he could rip them off. All the while UBS explicitly instructed its employees to avoid Madoff. “Not To Do: Ever enter into a direct contact with Bernard Madoff!!!” They knew he was running a Ponzi scheme.

When a executive of UBS who was involved in creating the new funds received an inquiry on what he was doing he replied, “Business is business. We cannot permit ourselves to lose $300 million.” [Source: ‘Predator Nation’.] Read it!

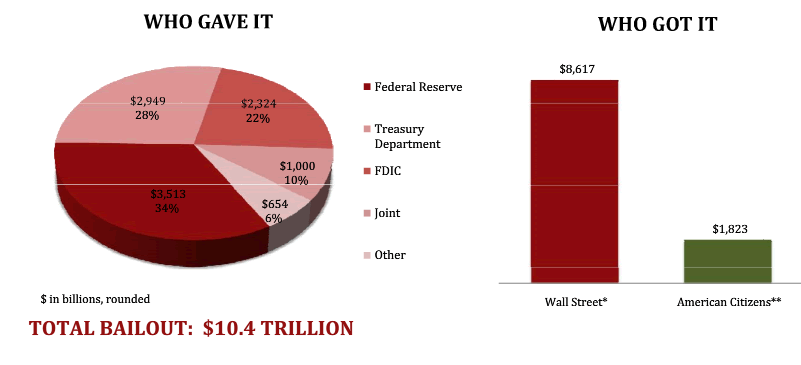

Then the criminals had their ex-CEO Hank Paulson hold a gun to our heads as he demanded a blank check, which to date has us paying out $10.4 trillion.

We pay for their criminal acts. Our kids pay for their crimes. Forty-five million Americans live in poverty as a result of absolute lawlessness. The Second Great Depression is a direct result of this.

And who does law enforcement go after? What does our legal system focus on?

You know where this it going...

The Texas Parks and Wildlife Department scoured the web and decided to investigate our gourmet cook and fellow blogger possessing wildlife resources that have “not been taken legally.”

The SEC has a massive budget and lawyers who spend their days looking at pornography, the Texas Parks and Wildlife Department surfs the web and wastes time on suicidal birds.

This is our economy. A Monopoly game of passing go and collecting $200 fake dollars printed by the "Fed". The banksters get rich on crime, you go to jail for no reason at all.

It is illegal to cook a bird that commits suicide by flying into the side of a house. Your house. On your property. All because the law says to acquire game you must have a hunting license and the correct ammunition.

Birdshot is acceptable ammo, vinyl siding is not.

Does the word “MORONS” come to mind?

Maybe the EPA will get in the act and outlaw houses to protect suicidal birds. Bright-light Linda Jackson headed up the Obama EPA. Like Bernanke—a Princeton educated appointee who couldn’t buy common sense if Amazon sold it online. Jackson’s resume is littered with criminal neglect and child endangerment on a massive scale. Her unit found out (during the Bush Administration) that a day-care facility was actually housed in a former thermometer factory and was exposing toddlers to mercury. Jackson failed to alert the parents for over 90 days.

Leadership material. Serious Princeton leadership material.

Cheney held secret energy meetings with CEOs in the energy sector. The EPA later excluded fracking-juice lakes from the Clean Water Act. Frack a well, dump 8 million gallons of water that has been mixed with 597 carcinogenic chemicals in a manmade lake and let it seep into wells and evaporate and rain down on us—that is okay. Let kids play in mercury and don’t tell parents, also okay.

Toxic bankster derivatives—also okay. Not wasting suicidal delicacies—not okay.

Do you understand how America works?

Greenspan, Phil Gramm and Rubin led the charge to repeal the Glass-Steagall Act. The Great Depression era fix created to prevent another depression. The firewall separating investment banks and commercial banks. Rubin’s reward? Vice chairman of Citigroup where he made $120 million.

Larry Summers, Alan Greenspan, SEC Chairman Arthur Levitt and Senator Phil Gramm got a law banning any regulation of OTC derivatives. From 2003-2007 $3 trillion in often fraudulent MBS were cranked out by America’s financial sector. [Source: ‘Predator Nation’]

If the banksters can get rich off changing a law, they get it changed. As a reward for changing the law the politicians like Rubin get paid off via a revolving door. Or, in other cases, the politicians write laws that allow them to make millions while in office. For instance: Spencer Bachus was chairman of the House Financial Services Committee and he shorted the DOW when it was above 11,000 on September 18, 2008 after Ben Bernanke and Hank Paulson gave him insider information during emergency economic briefings.

It is legal for Congress to trade on insider information. It is not legal for you to trade on insider information.

Nor is it legal for gourmet food connoisseurs to eat birds who commit suicide on their land.

"We've" created an economy based on manufacturing moronic laws that permit the criminals to pray on us.

Suicide by corporatocracy is not painless.

For the first time I've been alive: More Americans committed suicide than died in car crashes. Deaths from suicides rose 15 percent and deaths from poisoning rose 128 percent, the latter are often when intentional overdoses get classified as.

The only thing economically I've been wrong on so far is this: Celente said, "when people lose everything—they lose it." I optimistically thought he meant pitchforks and torches and not suicide.By D. Sherman Okst,

Bernardston MA USA

davos @ psychopathiceconomics.com

I'm an ex-airline captain with about 15,000 hours and am amazed at all the BS we are taught. Most of my friends still in the business were also taught the wrong aerodynamic principles with respect to what makes planes fly. Aviation or economics, Keynes to Austrian - Bernulli to Newton we've been sold bad goods. It's amazing anything works as backwards as we do things.

© 2011 Copyright D. Sherman Okst - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors

Huff Post : JPMorgan Chase Earnings Q3 2012: Bank Turns In Record Profit

JPMorgan Chase Earnings Q3 2012: Bank Turns In Record Profit

By CHRISTINA REXRODE 10/12/12 02:24 PM ET EDT

FOLLOW:

NEW YORK — JPMorgan Chase, the country's biggest bank, reported a record quarterly profit Friday, helped by a surge in mortgage refinancing. CEO Jamie Dimon said he believed the housing market "has turned a corner."

The bank made $5.3 billion from July through September, up 36 percent from the same period a year ago. It worked out to $1.40 per share, blowing away the $1.21 predicted by analysts polled by FactSet, a provider of financial data.

Revenue rose 6 percent to $25.9 billion, beating expectations of $24.4 billion. Earnings were also helped because the bank set aside less money for bad loans – $1.8 billion, down 26 percent from a year ago.

Revenue from mortgage loans shot up 29 percent. About three-quarters of that was from people refinancing, rather than buying new homes. Low interest rates and government help encouraged homeowners to refinance.

A Federal Reserve survey earlier this week found that a stronger housing market helped economic growth in almost every part of the country. Home sales are up, prices are rising more consistently in most places, and builders are more confident.

Dimon noted that the bank was still seeing a high level of souring mortgage loans, and said he expects high default-related expenses "for a while longer." And he noted homeowners are still struggling under mortgages they can't afford, saying the bank was working to modify those loans.

The bank gave few details on the surprise $6 billion trading loss that dominated its previous earnings report. It did mention that a credit portfolio moved to the investment bank from the chief investment office, which was responsible for the bad trade, "experienced a modest loss."

The bank set aside an extra $684 million for legal expenses. Chief financial officer Doug Braunstein said the reserves were related to "a variety of issues," and not just a lawsuit filed last week by the New York attorney general over mortgage-backed securities sold by Bear Stearns. JPMorgan bought Bear Stearns as it veered toward collapse in 2008.

Dimon said he couldn't predict how much the bank would have to spend in the future.

"Obviously we're in a litigious society," he said on a call with reporters. "We have a lot of mortgage suits coming and others. ... Hopefully it will come down over time but we can't promise you that."

The number of employees was up about 1 percent over the year. But it fell about 1 percent compared with the previous quarter. The bank shed about 3,300 jobs to 259,550.

Dimon said he believed the number of workers would continue to come down, partly because the bank will need fewer people to handle problem mortgages but also because the company would continue to look for efficiencies.

He declined to give specifics on how bonus season might play out early next year. "The company's doing quite well, and we want to pay our people fairly and properly as we always have," he said.

Dimon also declined to answer a question about what the board of directors might decide about his own pay. Some had speculated it would be cut because of the trading scandal.

"I would never tell you what our board of directors does, OK?" Dimon said. He was paid $23 million last year, mostly in stock awards.

JPMorgan's investment banking unit earned more in fees for underwriting stock offerings and debt offerings, which could signal that wary companies and investors are more willing to get back into the market.

Debit card revenue fell, which the bank attributed to new rules crimping the fees that banks charge stores whenever customers pay via debit card.

JPMorgan stock was down 22 cents in premarket trading at $41.88. The stock was as low as $31 in early June, after the bank announced the trading loss, which later ballooned to $6 billion.

The bank's revenue was slightly lower, $25.1 billion, when adjusted for a controversial accounting rule that penalizes banks when the bonds they issue to investors look safer and rise in value.

The theory behind the rule, in place since 2007, is that it would cost banks more to buy those bonds back from investors. The rule has been sharply criticized by the banking industry, including by Dimon, and could be phased out as early as next year.

ALSO ON HUFFPOST:

1 of 7

×Sort by Ranking

AP

3

3

5

5 4

4 2

2 1

1

Friday, October 5, 2012

The Peril of Obama's "Man Crush" on Geithner Is Exposed by the Debate

- Login with Facebook to see what your friends are reading

- Enable Social Reading

- i

React

Follow

FDR transformed the nation when he was confronted with the Great Depression and World War II. He famously welcomed the hate of the banksters. President Obama wanted the love (and the contributions) of the banksters. He chose Timothy Geithner to be his pipeline to the banksters because Geithner shared Obama's lack of passion for holding the banksters accountable for their frauds that drove the ongoing crisis.

We have known the core of these sad facts for years, for they were revealed (irony of ironies) in a May 22, 2010 article whose theme was that we had all done Geithner and Obama a terrible injustice by criticizing them for their servile approach to the banks. The key facts that the article disclosed can be summarized in a sentence: Obama developed a "man crush" on Geithner and decided to follow Geithner's policies to bail out the banksters rather than hold them accountable for the frauds that made them wealthy and caused the Great Recession. Obama's "man crush" is particularly odd given the fact that Geithner is a Republican who, as a fig leaf, became an independent.

I emphasize that Obama is the President and the man who chose Geithner to head Treasury and, eventually, become his principal advisor on finance and economics. While this article focuses on Geithner's role, the responsibility and culpability lie primarily with Obama.

I find the May 2010 article's sycophancy towards Geithner so appalling that it is acutely painful to, in the interest of brevity, ignore its defects and simply report its disclosures. Books published recently by Suskind, Barofsky, Bair, and Connaughton have confirmed and expanded these disclosures about Geithner's all-encompassing dedication to the interests of the banksters.

I argued in my first appearance on Bill Moyer's in April 2009 that Obama's acceptance of Geithner's advice to serve the interests of the banksters rather than America could cost him reelection. Romney and Ryan have been such terrible candidates with awful policies that recent polls have indicated that Obama has a substantial advantage in the electoral vote. Wednesday's debate, however, has exposed the political insanity of Obama's embrace of the banksters. (I have often explained why the policy is substantively insane and provide only the briefest summary here.)

The single most important thing that Obama could have done to respond effectively to the crisis and to prevent future crises was to take on the systemically dangerous institutions (SDIs) whose fraudulent CEOs drove the crisis. The SDIs inherently put us constantly at risk of systemic crisis, are so large that they are inefficient, make "free markets" impossible because they receive a huge, implicit federal subsidy, and pervert democracy into crony capitalism. Leaving the banksters in charge of our largest banks also guarantees recurrent, intensifying financial crises. Taking on the SDIs, particularly their CEOs who grew wealthy by looting "their" banks would have also been the single most just and politically popular action Obama could have taken.

I want to emphasize the "just" aspect. Holding the banksters accountable for their crimes has nothing to do with "pitchforks," vengeance, or scapegoats. Holding elite criminals accountable is a minimum condition for a democratic state that aspires to be a great nation. Americans yearn for a president who demands that we live up to our best natures. The May 2010 article unintentionally demonstrates the author's, Geithner's, and Bill Clinton's inability to even fathom the concept that justice requires holding the banksters accountable for their crimes. Indeed, the article descends into this loathsome slander of the American people.

[Geithner's] objective was to rescue the economy from ruin, and if the price was that a bunch of bankers benefited, he was happy to pay it. But Geithner was smart enough to realize that the simmering wrath of voters could complicate the politics around his efforts considerably. So the secretary ventured to Harlem to ask Bill Clinton's advice as to what might be done to cool the cauldron. According to Jonathan Alter's new book, The Promise, Clinton told him that his options were limited.

"You could pull Lloyd Blankfein into a dark alley and slit his throat," Clinton said, "and it would satisfy [people] for two days, and then the bloodlust would rise again."

Note the depth of their contempt for the American people. The American people did not want any executions of banksters, much less their murder in "a dark alley." Geithner, Clinton, and the author cannot even consider the compelling evidence that accounting control frauds led by the banksters drove the crisis. They have no understanding of accounting fraud, justice, or the damage caused to a nation when elite frauds can grow wealthy (and massively destructive) through fraud. They have no conception of what any competent regulator, economist, criminologist, or attorney would understand about a "Gresham's" dynamic. If cheaters prosper, then bad ethics drives good ethics out of the marketplace and fraud can become endemic.

The "price" that results from allowing elite frauds to become wealthy with impunity is endemic fraud, recurrent financial crises, grotesque economic inefficiency, and the perversion of markets and democracy through the descent into crony capitalism. Geithner will not bear this "price" -- America and Americans will. We were not informed of this price or asked whether we were willing to bear it. There was no legitimate need for us to bear the price because Geithner's grant of impunity to the elite frauds was unjust and harmed the economy and nation. The banksters are the most undeserving recipients of a U.S. government bailout in history. The odds are strong that the banksters will eventually share a portion of the massive bounty they received from the U.S. due to Geithner's policy recommendations with Geithner. They may hire him, arrange for him to run an international organization, or give him Larry Summers-level (massive) fees for speeches on the wonders of faux "stress tests." There are numerous ways for a senior government official to cash in.

No regulator would ever believe that leaving fraudulent CEOs in charge of banks produces economic stability. While Geithner, as President of the FRBNY, was supposed to be one of the nation's top regulators he, by his own admission, refused to regulate. Like Clinton, Geithner was a strong proponent of the financial regulation that helped to produce (with a huge assist from Bush) the intensely criminogenic environment that caused the crisis. Geithner and Clinton would be two of the last individuals in the world that one would ever select to create an effective program of regulating or prosecuting banksters.

It is amusing that Geithner would choose Clinton as his go-to guy on how to neutralize the public's outrage at Geithner's successful effort to convince Obama not to prosecute (or even seriously investigate) the elite criminals who grew wealthy by causing the crisis. First, it's not exactly a socially desirable expertise for which one wants to be known. Second, Clinton was the subject of the criminal investigations. He was the elite guy that much of the public was demanding be prosecuted. Third, Clinton immediately displayed his contempt for the American people by describing us as eager to murder bank CEOs by slitting their throats in a "dark alley" without any trial.

I am sure that that all Americans will be delighted to learn that Geithner decided that we should bear the price of his recommendation (accepted by Obama) to give the banksters who grew wealthy by causing the crisis de facto immunity from prosecution plus a bailout that would save their jobs and reputations and make them even wealthier. How convenient that the banksters were, as the May 2010 article shows, Obama's leading contributors (and Geithner's most likely future employer). Our saying as regulators during the S&L debacle remains true today: "the best return on assets is always a political contribution." In our day, the political contributions were used to influence politicians who sought to block us from holding the banksters accountable. The author's effort to render Geithner noble and Clinton sagacious for braving the public's (fictional) bloodlust in order to protect the noble banksters (aka: contributors) from the murderous public is revealing and comic.

Taking on the banksters would have required the Obama administration to rebuild the vigorous regulatory system essential to prosecute the banksters and prevent future crises. Obama, however, followed the advice of Geithner and Orzag (Obama's OMB appointee and another leading foe of regulation) and attacked regulation and regulators as the problem. Geithner's answer to Congressman Ron Paul's question about his role as the chief regulator of many of the nation's largest bank holding companies was "I was never a regulator." So true, but you're not supposed to admit it. Geithner was a catastrophic failure as a regulator.

Obama followed Geithner's advice and did not shape Dodd-Frank to target the true causes, particularly accounting control fraud, of the financial crisis. Obama did not appoint vigorous regulatory leaders and he appointed Attorney General Holder, whose failure to prosecute any elite white-collar Wall Street CEO involved in causing the crisis has continued the national disgrace of the Bush administration.

What does the Obama administration stand for with respect to the greatest financial crisis in four generations? Obama stands for bailing out the banksters and not prosecuting them. The administration's most cynical act was claiming that programs that were actually designed to bail out the banksters were programs to help distressed homeowners. Barofsky's (SIGTARP) bookreveals the sickening details.

[Elizabeth] Warren asked Geithner repeatedly about HAMP. After several evasions, Geithner said about the banks, "We estimate that they can handle ten million foreclosures, over time... this program will help foam the runway for them."

Romney lied repeatedly when he claimed that the Dodd-Frank Act creates a safe harbor for the SDIs. Obama failed to rebut the lies, but the greater problem is that because he listens to Geithner's advice Obama has done nothing to end the SDIs, which would have turned Romney's attack into Obama's triumph. Dodd-Frank should have ended SDIs and it would have if the President had rejected Geithner's advice. If Obama had pushed for Dodd-Frank to end the SDIs it would have smoked out the SDIs' defenders - which would have included Romney and Ryan. The continuing failure to remove the threat posed by the SDIs has nothing to do with (non-existent) Dodd-Frank safe harbors for the SDIs. But that actually demonstrates that the fault lies with Obama listening to Geithner. The administration, prior to and after the passage of Dodd-Frank had and has the statutory authority to shrink the SDIs to the point that they no longer pose a systemic risk to the global financial system. The Obama administration has followed the Bush administration policy of refusing to use that authority and the SDI problem increased greatly under both administrations.

During the debate, Romney changed his positions when he backed away from his plan to repeal Dodd-Frank and its financial regulations. Obama failed to point this out or explain why greater financial regulation was necessary. But we need to step back and consider why Romney would think he could get away with his lies and evasions on these points. If Obama had appointed vigorous regulators and prosecutors and made it a national priority to remove from office the banksters who control our SDIs and prosecute them Romney could not have attempted these lies. Obama would not have been on the defense -- he would be presenting himself as the president who led the successful campaign against the banksters.

Similarly, if Obama had appointed vigorous regulators who reestablished the criminal referral process that is essential for prosecuting elite banksters and adopting and enforcing the rules that would prevent future crises he would have been on the offensive taking credit for these successes. If Obama had fought to establish real relief designed to aid distressed homeowners rather than "foam the runway" for the banks Obama would be the hero. Instead, Obama followed Geithner's and Orzag's advice and derided and reduced regulation and cynically used programs purportedly designed to help homeowners to as yet another means to bail out the banks. Obama is incapable of reversing fields and endorsing vital regulations and real programs for the homeowners because of his "man crush" on Geithner -- the banksters' pipeline to the Obama administration.

The debate revealed that Obama does not stand for anything positive when it comes to the banksters or distressed homeowners. Geithner is not a banker or a technocrat. He is an American apparatchik who rose by attaching himself to powerful political patrons and telling them what they want to hear. That reflects badly on Obama. Geithner gave Obama the answers Obama wanted to hear -- we must not act against our largest donors (and Geithner's most likely future employer), the banksters, by holding them accountable for their frauds because if we were to do so the economy would collapse. Geithner's answer, which became administration policy, was to lie about the banksters' role in causing the crisis and the financial condition of the banks.

Obama should hold Romney accountable for his endemic lies during the campaign and debate, but he would be in a better position to do so if he fired Geithner and Holder, ended his administration's lies about the banksters, and reversed the administration's unjust and destructive financial policies. Obama needs to stand for something - he should stand for the American people against the banksters and the SDIs. The irony is that by following Geithner's advice Obama acted dishonorably and foamed the runway for Romney's lies about the financial crisis.

Subscribe to:

Comments (Atom)