Nowhere is the evidence of unbridled corporate greed stronger than in what the financial crisis did to the U.S. economy. The losses are staggering. Economic growth was killed to the tune of over $13 trillion. Homeowners lost a whopping $8.1 trillion in home values. Personal income nose dived. Between 2007 and 2010 median household net worth fell by $49,100 per family. That's a 39% loss.

What's worse is most have assumed the economy will eventually recover. There is an increasingly more real possibility. It never will. The reasons are a loss of private investment and since the U.S. worker has been scuttled, all of the expertise and skills have become atrophied. As the phrase goes, use it or lose it and businesses refusing to hire are making sure American workers are losing their skill sets.

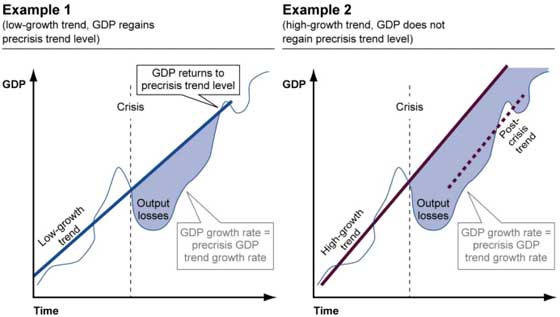

Below is a graph from the GAO report which shows the two scenarios. The first is when GDP recovers and returns to normal growth after a financial crisis. The second scenario is a financial crisis that has permanently destroyed the nation's economy. The bold line is potential GDP and what has been the trend of economic growth in the past. The wavy lines are actual economic growth.

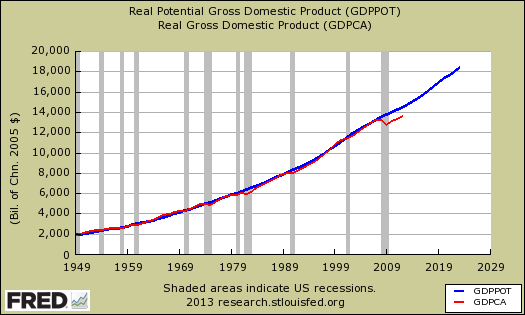

Now take a look at the below graph. This is potential GDP (blue) that our nation could generate versus what the real economic growth was (red) per year. We can see the United States has been really humming along ever since WWII from the below graph...until December 2007. You see that red line drop? That's real GDP. Now which of the two above scenarios, does the below graph look like? Is it example one or example two? It is graph two above. In other words, it's looking like the financial crisis has permanently decimated America's economic growth.

The GAO is really implying this is what has happened, the economic damage is permanent. So says the IMF as well. Their research gives a 25% economic loss as a trend for the four years following the crisis. That means that red line is now repressed by a whopping 25% of the past output trend.

Not only was economic output shifted lower like a 9.0 earthquake and tsunami, there are additional losses, many of which cannot be quantified, such as the human toll.

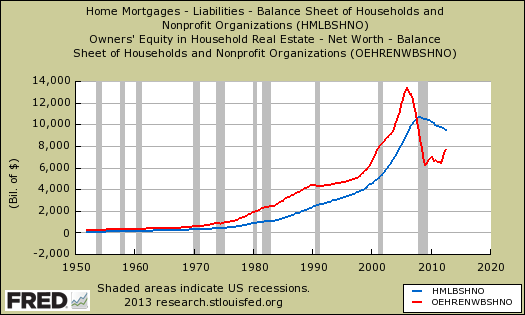

There was $9.1 trillion lost in home equity between 2005 and 2011 and dropping home prices is only part of the reason as people went bankrupt and were foreclosed on. For the first time since statistics were kept, mortgage debt exceeded home equity. That's all the way back to 1945. According to the GAO by December 2011 home equity was $3.7 lessthan total home mortgages owed. The below graph shows mortgage debt (red) against home equity (blue) as reported in the flow of funds report.

The recognition of just how bad the financial crisis was comes from a new GAO report,Financial Crisis Losses and Potential Impacts of the Dodd-Frank Act which, believe this or not, was chartered to justify the cost of implementing the Dodd-Frank financial reform bill.

Various political spinners blame the federal debt on Obama and the Democrats. There too, the ones to really blame are the Banksters and the reckless behavior of Wall Street. Federal debt went from 36% of GDP in 2007 to 62% by 2010. The causes are actually multi-fold but a huge one is decreased tax revenues. When people don't have jobs, they don't pay taxes. When businesses aren't making any money, they don't pay taxes. When people don't have jobs, they need unemployment insurance benefits and food stamps. Yes, the stimulus did add to the debt but so did bailing out the Banksters. Much to the contrary of what one hears about TARP turning profits, many of the bail outs did not did not makeprofits. The biggest are Fannie Mae and Freddie Mac, which the GAO reports have cost $316.2 billion.

The main point of the GAO report is letting banks run amok is costly. The financial sector really did implode the U.S. economy, along with most of Europe. Implementing Dodd-Frank is currently estimated at $1.2 billion. Hmm, let's see, $1.2 billion versus $22 trillion, which is larger? The question isn't whether there should be financial reform, obviously there should. The real issue is the ineffectiveness of Dodd-Frank. Even the GAO hints at this with the wishy-washy could work, depends paragraph opener:

The Dodd-Frank Act contains several provisions that may benefit the financial system and the broader economy, but the realization of such benefits depends on a number of factors.

The reason for that is way too much is left to regulators and some imply the bill actually increased systemic risk. Take derivatives for example. They still are going strong and have the potential to once again blow up the economy.

Assuming the risk of counterparty default—most CDS and most other swaps have been traded in the OTC market where holders of derivatives contracts bear the risk of counterparty default.In addition, swaps traded in the OTC market have typically featured an exchange of margin collateral to cover current exposures between the two parties, but not “initial” margin to protect a nondefaulting party against the cost of replacing the contract if necessary. As of the end of the second quarter of 2012, the outstanding notional value of derivatives held by insured U.S. commercial banks and savings associations totaled more than $200 trillion.

These derivatives have been moved to clearing houses and systemic risk along with it. Now the clearing houses themselves are vulnerable to need a bail out. But that's what ya get when Congress is corrupt and derivative loving lobbyists rush in to prevent any reform passage.

The costs of Dodd-Frank are shockingly high. Yet when one writes a labyrinth that's the price. But that's really not the issue which needs to be brought to light. Will the financial reform bill stop the next financial crisis? From the report:

The Dodd-Frank Act’s potential benefit of reducing the probability or severity of a future financial crisis cannot be readily observed and this potential benefit is difficult to quantify.

What a surprise but when one has a swiss cheese regulation maze, figuring out how many rats can get through it is tough. There was some Basel committee analysis on capital ratios and margins correlated to a lower next financial crisis probability.

Higher capital and liquidity requirements can reduce the probability of banking crises. For example, the models suggest, on average, that if the banking system’s capital ratio—as measured by the ratio of tangible common equity to risk-weighted assets—is 7 percent, then a 1 percentage point increase in the capital ratio is associated with a 1.6 percentage point reduction in the probability of a financial crisis.

Worse than that, the do not know if Dodd-Frank will reduce the probability of another financial crisis even by a small percentage. They don't know. Five years later, a ridiculous amount of rules and governments world wide have no real clue on how to stop the next one, especially with Dodd-Frank. With $200 trillion in derivatives out there like nukes of the cold war, it's no surprise systemic risk is yet to be quantified.

Along with Too Big to Fail and Too Big To Jail we need to add a new phrase. If one cannot quantify systemic risk, then those elements should not exist

No comments:

Post a Comment