Economics / BankstersMar 06, 2013 - 10:04 AM GMT

By: Brian_Bloom

The world economy has become moribund. “Money” does not power the economy. It merely acts as grease for the economic wheels. For some reason, the banksters are obtusely refusing to see this. Perhaps they don’t fully understand. Perhaps the lobby groups who are influencing political decisions don’t want them to see/understand. Perhaps they do understand but don’t know what to do about it. Whilst the Long Economic Wave may be bottoming – at least in the US – the next “upswing” will very likely not resemble previous upswings. There has been a chronic dilution of the potency of the forces that drove the Industrial Revolution which commenced in the mid 1700s. In this context, we cannot apply historical thought paradigms to future planning. A new mindset must evolve. The longer it takes for the decision makers to recognise this, the more difficult it is going to become to address the core issues.

The world economy has become moribund. “Money” does not power the economy. It merely acts as grease for the economic wheels. For some reason, the banksters are obtusely refusing to see this. Perhaps they don’t fully understand. Perhaps the lobby groups who are influencing political decisions don’t want them to see/understand. Perhaps they do understand but don’t know what to do about it. Whilst the Long Economic Wave may be bottoming – at least in the US – the next “upswing” will very likely not resemble previous upswings. There has been a chronic dilution of the potency of the forces that drove the Industrial Revolution which commenced in the mid 1700s. In this context, we cannot apply historical thought paradigms to future planning. A new mindset must evolve. The longer it takes for the decision makers to recognise this, the more difficult it is going to become to address the core issues.

*******

The “cause” of the moribund world economy has not been the existence of a fiat currency system or the absence of a gold standard. For example, those who are arguing for a gold standard as a partial solution to our economic problems, are missing the point by a country mile. Yes, a gold standard might be nice to have – rather like an Indian motorcycle would be nice to have. It will make those who own it feel better. But, like the Indian motorcycle, if the engine is worn out and/or if the gas tank is empty then the vehicle won’t be going anywhere. Arguably, the global economy is worn out and is running on fumes.

Growing sovereign debt is a symptom. Volatility in the capital markets (including the precious metal markets) is a symptom. Budget deficits are symptoms. The time has come to lift our sights and understand the “real” issues that are impacting on the global economy – the drivers of the symptoms. Without such understanding there is no hope of addressing those issues.

However, before we do this, we need to examine what has been happening within the world economy.

At one end of the spectrum – in the largest economy amongst the deficit nations – the US Fed stubbornly continues to inject substantial quantities of new liquidity into the US economy. Quote: “The Fed is currently buying $85 billion in bonds each month and has said it plans to keep purchasing assets until it sees a substantial improvement in the outlook for the labor market.” (Source: http://news.yahoo.com/bernanke-face-fed-critics-testimony-congress-050311854--business.html ).

At the other end of the spectrum, China – which is (supposedly) the largest economy amongst the surplus countries, and is also a centrally controlled economy – has (so far) constructed over 64 million apartments that remain unoccupied within China, and is also constructing apartments outside China, which also remain unoccupied.).

This staggeringly large number was reported by SBS Dateline in March 2011. As SBS is an Australian Government sponsored TV network, I was prepared to accept it at face value. (The reader can access the actual documentary program, and the article on African apartments at:http://www.beyondneanderthal.com/research-links/economicsfinance/:

At the low end, $70,000 to $100,000 was mentioned as the value of these apartments. At the high end, asking prices of $300,000 were discussed.

Assuming that the average apartment is worth (say) $100,000, those 64 million apartments represent around $6.4 trillion of dead capital. On an annual salary of around $10,000 (mentioned in the documentary) the affordability ratio is 10X. (Price divided by annual income). This multiple compares with around 6.9 X in Australia, in 2009, and with “a ratio of 5 considered severely unaffordable” (Source: http://economics.hia.com.au/media/House%20price%20to%20income%20ratio%20-%20FINAL.pdf )

The $6.4 trillion number – which happens to be around 42% of the entire $14.9 trillion GDP of the USA in 2011 – also serves to explain what has been “driving” the Chinese economy, the wheels of which have been spinning. Yes, rubber is being burned, but the tires on those wheels are enjoying little traction. $6.4 trillion also happens to represent nearly 90% of China’s entire 2011 GDP. (see: http://en.wikipedia.org/wiki/List_of_countries_by_GDP_(nominal) ).

Now let’s look more closely at some of China’s fantasy numbers:

According to that country’s statistical year book, China’s GDP has been as follows since 2000 (source:http://en.wikipedia.org/wiki/Historical_GDP_of_the_People's_Republic_of_China ):

Table #1: China’s Annual GDP, 2000-2011. In US$

Interim Conclusion #1

It took China 12 years to add slightly more cumulative value to the world economy than was added by the US in 2010 and 2011. If the SBS Dateline numbers are correct, the centrally controlled Chinese economic miracle is not what it seems. It has not been adding “real” value to the extent claimed.

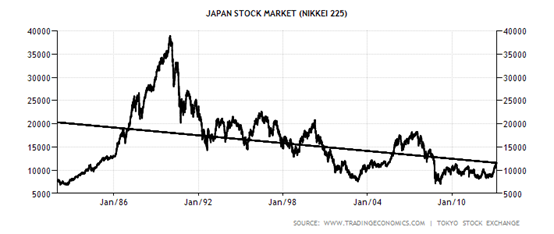

And then there’s Europe, MHDSRIP; and Japan, whose stock market looks like this: (source http://www.tradingeconomics.com/japan/stock-market )

Chart #1 – Nikkei 225 Index – January 1982 to February 2013,

(with trend line).

After peaking at 38,916 in December 1989, the Nikkei was trading approximately 70% lower as at March 4th 2013 (23 years later).

Table #2 – 2011 GDPs of the top 4 economic regions of the world, in US$ (Trillions)

- (source: http://www.gfmag.com/gdp-data-country-reports/631-the-european-union-gdp-economic-report.html#axzz2MXnmgfuf )

Interim Conclusion #2

The top 4 regions of the world – whose economies account for 62.8% of the total world economy – are currently moribund.

From an investment perspective, if the majority of the world’s output engine is on the verge of becoming obsolete, this raises a significant question regarding the following chart of the S&P 1200 Global Industrial Index. Are we witnessing the beginnings of a rebirth – as new technologies emerge to replace old ones? (http://www.google.com/finance?cid=10264130 )

Chart #2 – S&P 1200 Global Industrial Index

Superficially, the similarity between the shape of the above graph and that of the red line in Chart #2 below, of nominal US median household income, should be seen in context of the blue line below (inflation adjusted US median household income). (source: http://beforeitsnews.com/economics-and-politics/2013/03/understanding-failed-policies-wealth-effect-wage-effect-poverty-effect-2450392.html ).

By implication, asset prices have been rising because the central banks have been flooding the markets with cash. i.e. The rising stock markets have not been anticipating economic growth. The primary driver of this “may” have been the rising level of liquidity in the monetary bathtub. In simplistic terms, the cash had to land up somewhere.

Chart #3 – Median US household incomes – nominal vs real

Recognising that is has been “sound bites” that have contributed to the broad state of confusion of the general public perhaps we should look a bit deeper below the surface. Maybe there’s more to what’s been driving the stock markets than meets the eye.

Clearly, from the analysis above, the most relevant economy in the world remains that of the USA. On its own, it still accounts for 21% of the world’s total; and probably more if you adjust for the Chinese puffery.

One of the most competent economic analysts that I have come across in the past 45 odd years of watching and analysing the markets is Tony Boeckh, originally one of the founding editors of the Canada-based Bank Credit Analyst and now the publisher of the Boeckh Investment Letter. (www.boeckhinvestmentletter.com )

In his letter of February 21st 2013, entitled “How sustainable are elevated corporate profits?”, Tony makes the following point pursuant to a fascinating high level analysis of US corporate profits:

“The long wave economic decline discussed above is probably in its troughing phase and poised for the next upswing. The high level of [corporate] profits relative to wages, if it does not create a poisonous and destructive backlash, will play a key role in driving the next long wave upswing.”

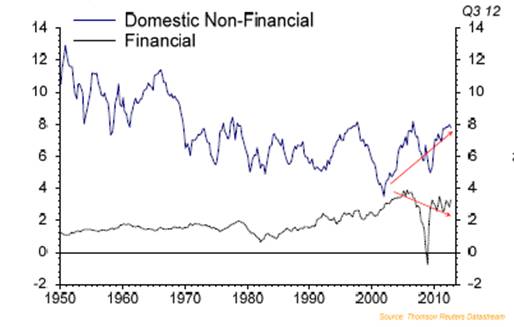

The following chart reflects the fact that corporate non-financial profits have been growing as a percentage of the national income pie since around 2000, whereas financial profits have been decreasing. This chart talks specifically to the “value-added” by the two sectors.

Chart #4 - U.S Corp. Profits as a Share of National Income

Hopefully, I am not doing Tony a disservice by attempting to cherry pick from his arguments, but there appear to have been three reasons for this improving level of corporate profitability:

- Employees have indeed suffered a decline in real wages and corporate profits have benefited from this.

- Interest rates have been declining,

- Corporations have been extracting productivity gains from their work-forces in preference to making new capital investments, which has significantly benefited their cash flows.

The net result has been that US corporate balance sheets are in good shape – as are the balance sheets of banks in general – and the US is now cashed up and ready to invest. In any event, corporations now need to invest because productivity has been declining in recent months.

Unfortunately, (this is now my interpretation, not necessarily Tony’s) the US economy was kept alive by allowing consumers to live on credit, and because government stepped in to increase its share of the economic pie (also on credit) to soften the impact of reduced corporate investing.

I agree with Tony that we may well be witnessing a troughing of the Long Economic Wave – at least in the US – but this pesky debt won’t just go away. Further, as he argues, there is likely to be growing market pressures for increases in both wages and interest rates. From one perspective this is likely to put a damper on corporate profits. However, from another perspective, if wages start to rise in real terms, and given that the US consumer accounts for 2/3 of the US’s GDP, this is likely to put a “floor” under corporate profits because corporations will likely experience rising revenues that will (partially?) offset falling profit margins. Net, net, it will be a satisfactory outcome if corporations can maintain profits or suffer minor falls in profits in the immediate years ahead. But it seems likely to me that this positive change in circumstances will more likely give rise to a churning of the stock market as consumers use part of their increased incomes to pay down debts, and as the budget balancing focus of government causes its share of the economic pie to shrink; even as the corporate share grows – hopefully to compensate.

Interim Conclusion #3

Given the headwinds implicit in the debt overhang, the downward pressures on corporate profits because of anticipated rising wages and rising interest rates, and the likely rebalancing of capital contributions between the public and private sectors, the economic “healing” process is more likely to take decades than years. Things might well start to improve, but we are decades away from hitting a similar “sweet spot” in the economy that prevailed in the years leading up to 2000 – if ever.

Now we come to the meat of this analysis:

In this analyst’s view, the sweet spot will never return. It has not yet become generally recognised or accepted but the very nature of the game has changed, and the drivers of this change need to be understood. Whilst the economy will continue to consist of people and organisations exchanging value that they have created, the old rules that applied to wealth accumulation will no longer apply in the same way.

From a high level, the following macro forces are ultimately driving the symptoms that were referred to in the opening paragraphs of this article and, because the forces are global in nature and, because the world economy has become symbiotically interdependent, local politicians in individual countries are effectively spitting into the wind. That is why what may have worked in years gone by will not be effective in the years ahead.

It will be a gradual change. Over the coming months it is my intention to look more closely at the relationships and the implications of what follows. For the present it will be sufficient merely to document their existence.

- In 1945, the world’s population was a little over 2 billion. Today the number is a little over 7 billion. In round numbers, the world’s population has increased by 250% since the end of World War II. This has given rise to a heightened sense of competitiveness in a world that has embraced the concept that it is self-interested behavior that drives economic activity.

- Given that our planet’s resources are finite (although still relatively plentiful) the population explosion coupled with the mindless rush to gain access to these resources for self interested profit ahead of competitors has given rise to unacceptable levels of pollution. This has had several impacts, the main ones of which have been:

- Deterioration in the quality of topsoil which impacted on agricultural yields per hectare; and which impact was ameliorated by the use of chemical fertilizers which, in turn, have found their way into the waterways.

- A serious deterioration in both the per capita availability, and the quality of potable water – without which no terrestrial life can survive.

- Increased acidification of the planet’s oceans, which is impacting on the ecological balance of the entire planet.

- Destruction of vast swathes of oxygen producing forests as land has been cleared for agricultural purposes and also for the profits flowing to the timber industries

- Rapidly increasing concentration levels of Carbon Dioxide in our atmosphere which millions of years of planetary history tell us has accompanied climate change. (It is not relevant whether CO2 is a cause or an effect. What is relevant is that our climate is changing in ways that no one alive has experienced at the coal-face.)

The lake of toxic waste at Baotou, China, which has been dumped by the rare earth processing plants in the background

Read more: http://www.dailymail.co.uk/home/moslive/article-1350811/In-China-true-cost-Britains-clean-green-wind-power-experiment-Pollution-disastrous-scale.html#ixzz2McW44XiI

- As the pace of competition has hotted up, the levels of testosterone in our largely Alpha-male dominated society have been rising. In my first fact-based novel, Beyond Neanderthal, I devote a couple of chapters to explaining how this occurs. Suffice it to say now that raised levels of testosterone, coupled with egocentric behaviour, leads to chest beating of the type manifested by silver-backed gorillas in the jungles of Africa when they want to cow their potential competition into submission. Inevitably, as the competition for limited resources hots up, the chest beating morphs to become violent disagreement and a “winner-takes-all” attitude. In turn, this has led to a society-wide mindset that “the end justifies the means” and the level of aggressive behaviour in society has been rising – from books, movies and TV programs sending out “macho” messages to the general public on a ground-zero level, and because such a mindset has sanctioned the arrogant behaviour of politicians and Captains of Industry on a higher level which, in turn, has led to the Clash of Civilisations on the highest level.

By way of illustration, below is a photograph of a political demonstration by Muslims in Europe.

The meaning of the word “Islam” is “to submit” (to the will of God). Anyone reading these signs might conclude that the “will” of Allah is more related to violence and hatred than to love and peace. Clearly, the souls of the Imams who preach these messages of vitriolic hatred to their communities are inhabited by their own personal ego and toxic testosterone demons. Islam was never intended to be a religion of “slay[ing]”, “demolition”, “extermination”, and “butcher[ing]” - was it?

- One consequence of this generalised deterioration in the level of ethical behaviour across all levels of society is that the so-called “Rule of Law” has become separated from the foundation of ethics on which it was originally constructed. Quite absurdly, the function of the legal profession has morphed to become largely that of advisors to self-interested entrepreneurs and corporations on how they might “avoid” complying with the law or a contract, rather than what their clients should be doing to comply with them; and “compliance” with the law/contract has now been reduced to a robotic exercise in box-ticking. Nowadays lawyers are paid huge sums of money to find gaps between the boxes. When they do, and to fill the gaps, the lawmakers then move to introduce yet more boxes to tick, and the function of the courts has been reduced to interpreting behaviour relative to ticked (or un-ticked) boxes, rather than interpreting whether the behaviour complies with the underlying intention of the laws/contracts. By way of example, this analyst has seen many, many contracts where one of the opening boilerplate paragraphs that precede the actual contract reads: “The headings in this Agreement are for reference only and shall not affect the interpretation of this Agreement.” What this translates to mean, in English, is: “Please disregard any principles that you think might be implicit in this contract, and focus on the detail.” If it were not so serious it would be laughable. And thus, the Rule of Law continues – unnoticed – to disintegrate.

- Historically, education was all about providing all students with the ability to fish in any waters – from oceans to rivers, to lakes, or wherever. Now, an increasing proportion of students is being churned out on conveyor belts with a modest proficiency in fishing with a particular type of rod and a particular type of bait, in a specific local pond. Amazingly, when ordinary (middle to lower class) students fail to pass muster, the educational standards are lowered so that many schools are churning out “graduates” who have inadequate proficiency in the “Three R’s” of reading, writing and ‘rithmetic. Mass education today is all about preparing students to earn a living as they hit the work-force. And of course I am generalising here. The reader should not fall into the trap – like many lawyers - of focusing on the detail. The principle is that our education system in the West is not providing ordinary students with the ability to cope with any change, let alone the rapid change we have been experiencing. Many who are amongst the ranks of unemployed today will never be employed again. Its not that they don’t have the skills. It’s that they don’t have the basic skills to acquire the different skills that are needed.

- Finally, and overarching all of the above, the past 30 odd years has seen a deterioration in the Energy Returned on Energy Invested in fossil fuels across the board. If the reader has an interest to gain a detailed understanding of this, he/she might refer to a study entitled EROI of Global Energy Resources, by Lambert, Hall et al, and submitted to the UK’s Department for International Development on November 2nd 2012. The importance of this deterioration in EROEI flows from two facts:

- Against a background of “flat” gross global annual output of energy per capita, the net output of energy per capita has been falling for 30 odd years.

- As energy is what facilitates economic activity, a contraction in net per capita output of energy translates to a contraction in the ability of the global economy to continue expanding – quite apart from 1-5 above. (See “What Caused the Global Financial Crisis at http://www.beyondneanderthal.com/what-caused-the-global-financial-crisis/ )

Whilst the US may well be experiencing the troughing out of the Long Economic Wave, the evidence suggests that the historical emphasis on economic “growth” – that has prevailed since the dawning of the Industrial Revolution in the mid 1700s – will not be achievable (or appropriate) on a go-forward basis. Whilst the emphasis on economics will continue to revolve around value-add and exchange of values, “volume” of output (real GDP) will very likely not be “the” measure of success in the future. Acquisition (and accumulation) of wealth will be a function of adapting our entrepreneurial and investor behaviour to satisfy market needs ahead of frivolous wants. Individual discretionary spending will come to be much more carefully allocated – as was the case in the post Depression years. Drawing a long bow, it seems that value-add will come to be a function of quality of output rather than of quantity. For example, doubling the output of the coal mining industry will unlikely add to the overall quality of life on this planet. Apart from anything else, it will require significantly more energy to clean up the coal; or to clean up the environment if the coal is not cleaned.

Author Note:

Of course, the above begs the question as to how we will be able to move from where we are to where we want to be. This, in part, is what my two fact based novels attempt to address, but they will need to be read by large numbers of people to have any impact. Hopefully, you will play your part by helping to create a broadening interest. In the coming weeks/months I hope to focus in my blogs on some specific aspects of this question of a migration road map.

Author, Beyond Neanderthal and The Last Finesse

Beyond Neanderthal and The Last Finesse are now available to purchase in e-book format, at under US$10 a copy, via almost 60 web based book retailers across the globe. In addition to Kindle, the entertaining, easy-to-read fact based adventure novels may also be downloaded on Kindle for PC, iPhone, iPod Touch, Blackberry, Nook, iPad and Adobe Digital Editions. Together, these two books offer a holistic right brain/left brain view of the current human condition, and of possibilities for a more positive future for humanity.

Copyright © 2013 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive

|

No comments:

Post a Comment